‘People are drowning in debt’ – crackdown on loan sharks welcomed

Radio NZ News 6 June 2020

Radio NZ News 6 June 2020

Family First Comment: Finally. We’ve asked successive governments for a cap on interest rates for years!

“ the amount of interest that finance companies can charge on loans is capped. Mobile traders are now required to adhere to responsible lending requirements and lenders cannot offer credit to an applicant who has taken two high-cost loans in the past 90 days. There is also a maximum daily interest rate – of 0.8 percent per day – that can be charged on loans.”

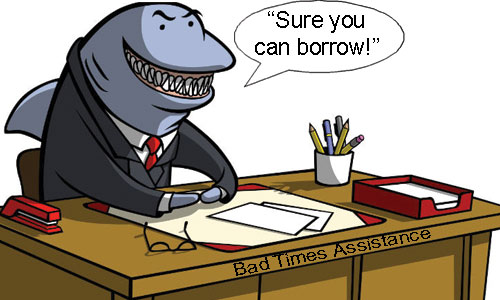

Manukau Urban Māori Authority has welcomed the government’s new regulations to crack down on predatory lending.

The changes to the Credit Contracts and Consumer Finance Act came into effect on 1 June and are designed to reduce the impact of loan sharks and mobile traders offering crippling high-interest rate loans.

Under the new protections, the amount of interest that finance companies can charge on loans is capped.

Mobile traders are now required to adhere to responsible lending requirements and lenders cannot offer credit to an applicant who has taken two high-cost loans in the past 90 days.

There is also a maximum daily interest rate – of 0.8 percent per day – that can be charged on loans.

The government announced in April that it was fast tracking changes, due to fears desperate households would resort to high-interest loans during the coronavirus economic crisis.

Manukau Urban Māori Authority general manager of whānau services Veronica Henare said for areas like South Auckland, where predatory lending is a real problem, the new regulations have been a long time coming.

READ MORE: https://www.rnz.co.nz/news/ldr/418394/people-are-drowning-in-debt-crackdown-on-loan-sharks-welcomed